Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wells fargo mortgage?

Wells Fargo Mortgage is one of the largest mortgage companies in the United States. It offers a wide range of mortgage products including conventional, jumbo, FHA, VA, and home equity loans, as well as reverse mortgages. Wells Fargo Mortgage also provides a variety of online tools and resources to help customers manage their mortgage, such as an online mortgage calculator and budgeting assistance.

Who is required to file wells fargo mortgage?

Individuals who have obtained a mortgage from Wells Fargo and meet the criteria set by the Internal Revenue Service (IRS) are required to file Wells Fargo mortgage. This typically includes individuals who have earned taxable income and have received certain tax forms related to their mortgage, such as Form 1098 (Mortgage Interest Statement) or Form 1099-C (Cancellation of Debt). It is always recommended to consult with a tax professional or refer to IRS guidelines to determine specific filing requirements.

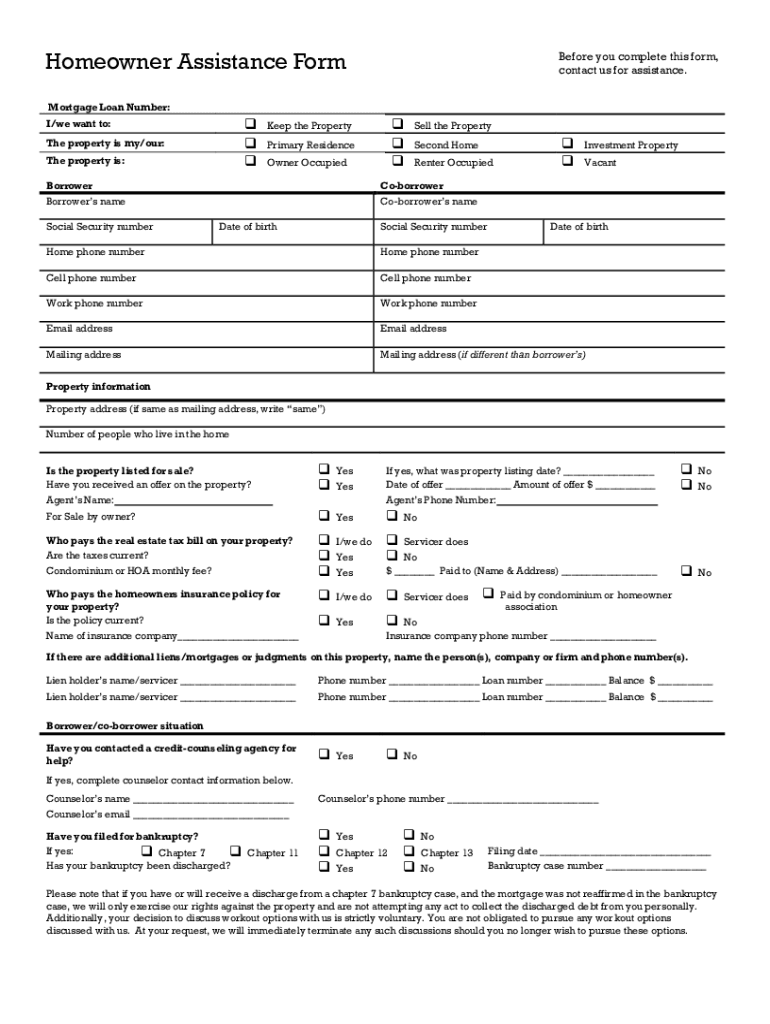

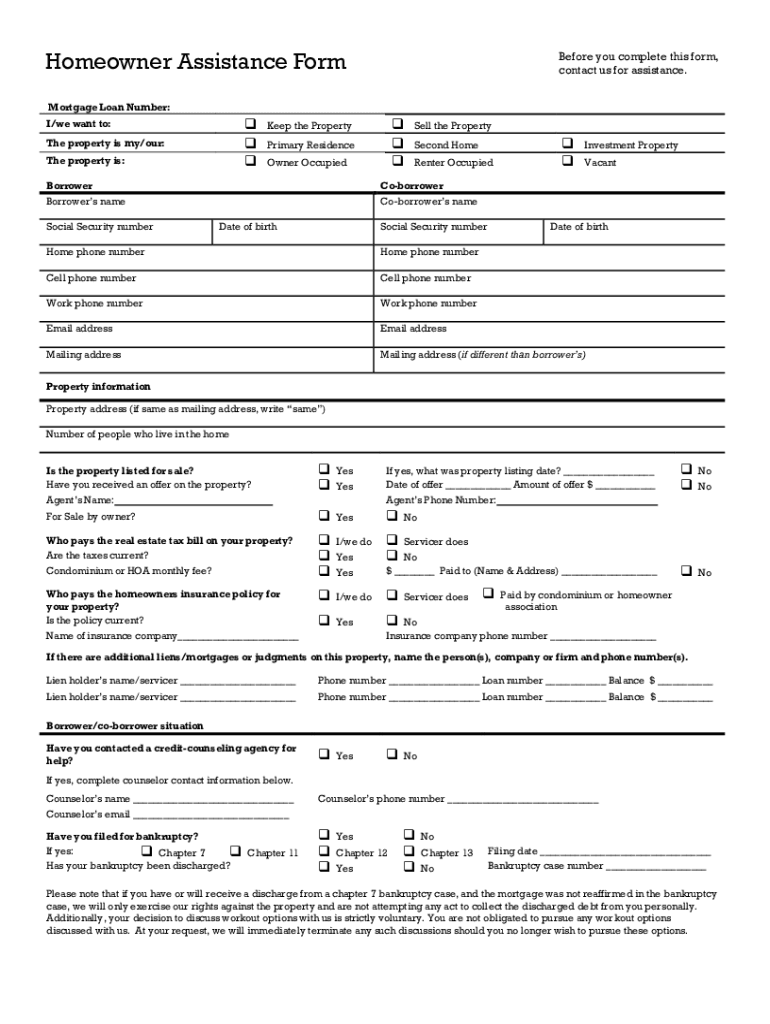

How to fill out wells fargo mortgage?

Filling out a Wells Fargo mortgage application involves several steps. Here's a general guide on how to fill out the application form:

1. Obtain the application form: You can find the mortgage application form on the Wells Fargo website, at a local branch, or by contacting a loan officer.

2. Personal information: Start by providing your personal details. This includes your full name, contact information, and Social Security number. You may also need to provide information about any co-borrowers or additional applicants.

3. Loan information: Specify the loan program you are interested in, such as a fixed-rate or adjustable-rate mortgage, and indicate the loan amount you are seeking.

4. Property information: Provide details about the property you intend to purchase or refinance, including the purchase price or estimated property value, property type, and its address.

5. Employment and income: Furnish your employment history, including current and previous employers, job titles, and dates. Additionally, input your monthly income details, including all sources of income, such as wages, investments, or rental income.

6. Assets and liabilities: List your assets, such as bank accounts, retirement funds, and investments. Also, provide information about your liabilities, including credit card balances, loans, and other debt obligations.

7. Financial information: Disclose information about your current expenses, such as rent, utility bills, and other financial obligations.

8. Declaration and certifications: Read and sign the required declarations and certifications, confirming the accuracy of the information provided and acknowledging your responsibility for the loan.

9. Submit supporting documentation: Wells Fargo may require supporting documents, such as pay stubs, bank statements, tax returns, and identification proof. Attach these documents to your application.

10. Review and submit: Review your application form carefully, ensuring all the information is accurate and complete. Make a copy for your records and submit the application and supporting documents to Wells Fargo via mail, in-person at a branch, or through the online application portal.

Keep in mind that the process may vary depending on your specific circumstances and the requirements of Wells Fargo. It's always a good idea to consult with a loan officer or contact Wells Fargo directly for any specific guidance or assistance during the application process.

What is the purpose of wells fargo mortgage?

The purpose of Wells Fargo Mortgage is to provide financing and lending services for individuals and families looking to purchase or refinance homes. Wells Fargo is one of the largest mortgage lenders in the United States, offering a wide range of mortgage products and services to suit the diverse needs of homebuyers. The company aims to assist customers in realizing their homeownership goals by providing competitive rates, flexible terms, and personalized mortgage solutions.

What information must be reported on wells fargo mortgage?

When reporting on a Wells Fargo mortgage, the following information must be included:

1. The basic details of the mortgage, such as the borrower's name and contact information, the loan account number, and the property address.

2. The mortgage terms, including the loan amount, interest rate, repayment period, and type of loan (e.g., fixed-rate, adjustable-rate, etc.).

3. The status of the mortgage, including whether it is active, delinquent, or in default.

4. The payment history, including the monthly mortgage payments made by the borrower and any late or missed payments.

5. Any changes or modifications made to the mortgage terms, such as loan modifications or refinancing.

6. Information about escrow accounts, if applicable, including the amounts held for taxes and insurance.

7. Any fees or charges imposed by Wells Fargo, such as late fees, prepayment penalties, or insurance premiums.

8. Any legal actions related to the mortgage, such as foreclosure proceedings or bankruptcy filings.

It is important to note that the specific information required for reporting may vary depending on the purpose and format of the report, as well as any legal or regulatory requirements in the relevant jurisdiction.

What is the penalty for the late filing of wells fargo mortgage?

The penalty for the late filing of a Wells Fargo mortgage can vary depending on the specific terms and conditions outlined in the mortgage agreement. Late fees are typically assessed for each day the payment is overdue. It is advisable to check the mortgage agreement or contact Wells Fargo directly to determine the specific penalty or fee structure for late filing.

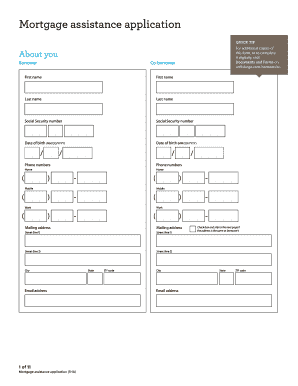

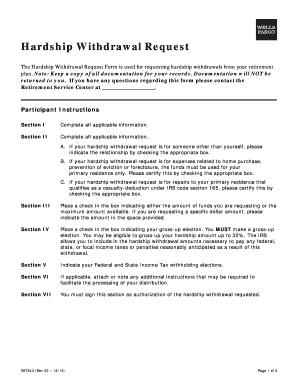

How do I make changes in wells assistance form?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your wells hardship assistance form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in wells fargo hardship assistance form without leaving Chrome?

wellsfargo com homeassist can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my wells fargo home assist in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fargo hardship home form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.